Top FAQs answered by Little Rock accounting professionals

Top FAQs answered by Little Rock accounting professionals

Blog Article

Comprehending the Function of Audit Services in Effective Organization Workflow

When it comes to running a successful company, accountancy solutions are more than simply number-crunching. There's even more to it than satisfies the eye-- uncover exactly how leveraging innovation can better boost your financial procedures and maintain your service dexterous in a constantly changing market.

The Significance of Accurate Financial Reporting

When it pertains to running a successful service, exact financial reporting is important for making notified choices. You depend on exact data to understand your company's financial health, track performance, and recognize fads. Without exact records, you run the risk of making misdirected choices that could endanger growth and profitability.

Clear financial declarations assist you evaluate capital, productivity, and total stability. They give understandings into your company's strengths and weak points. By consistently assessing these reports, you can detect prospective issues early and take corrective activities.

Additionally, accurate coverage builds trust fund with stakeholders, including capitalists and loan providers, who need trusted details before committing their sources. It also ensures conformity with guidelines, lowering the danger of legal problems (Little Rock accounting). Ultimately, when you focus on precise monetary reporting, you're setting your service up for success and making it possible for much better critical preparation for the future

Budgeting and Forecasting for Strategic Planning

Budgeting and projecting are crucial devices that assist you browse the intricacies of tactical planning. By developing a budget, you designate resources efficiently, making sure that every dollar is spent sensibly to fulfill your organization objectives. Forecasting supplies understandings into future monetary performance, helping you expect difficulties and take chances.

When you combine these 2 processes, you obtain a more clear image of your firm's monetary health. You'll be able to establish sensible targets, measure development, and make notified decisions. Frequently reviewing your budget and forecasts permits you to get used to transforming market problems and interior dynamics.

Reliable budgeting and forecasting likewise facilitate interaction with stakeholders, as you can present well-supported financial strategies. In turn, this fosters trust and straightens everybody towards typical purposes. Inevitably, mastering these techniques placements you for long-lasting success and sustainability in your organization undertakings.

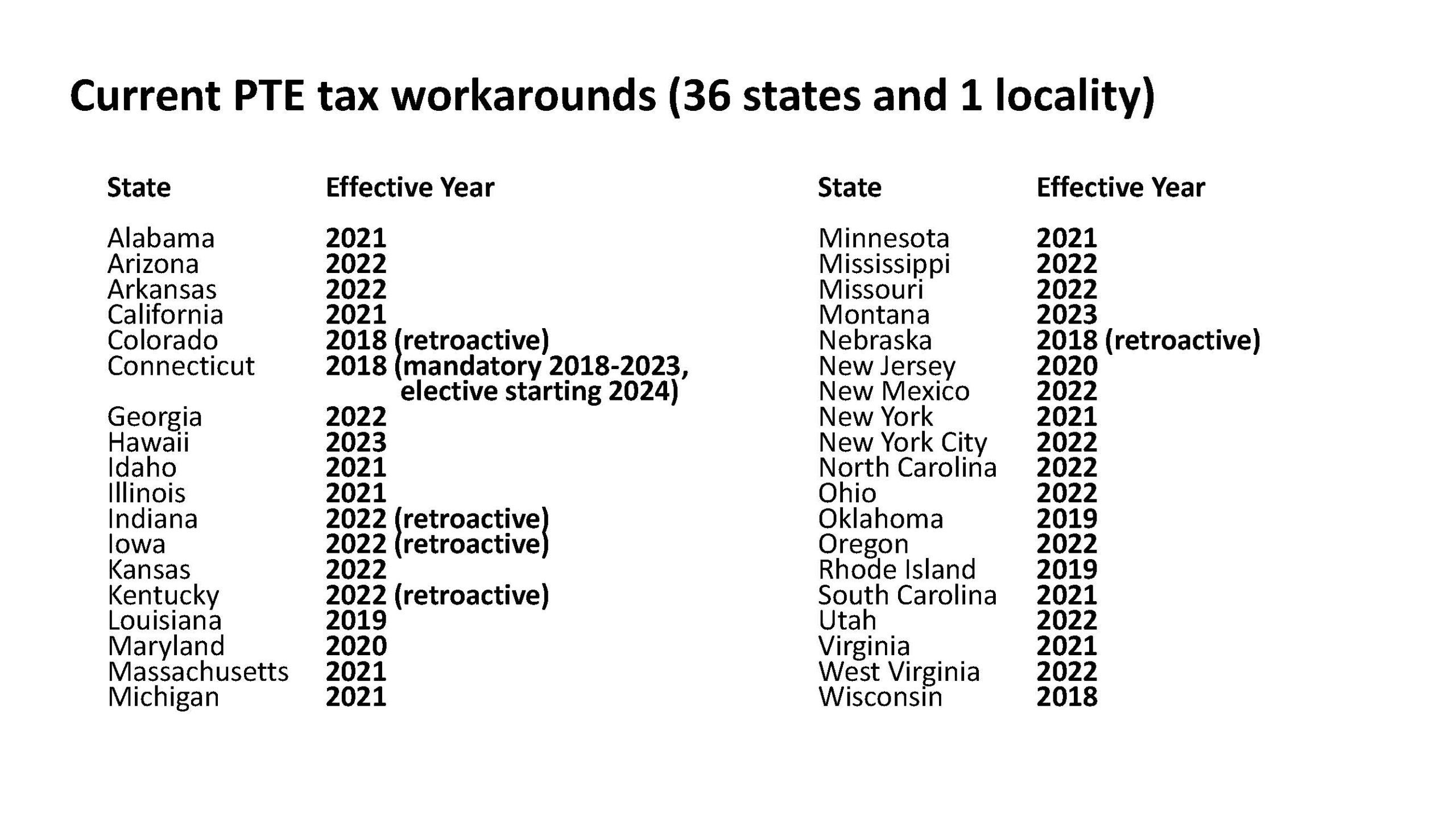

Tax Compliance and Planning Approaches

Tax compliance is important for your service to prevent fines and preserve a great standing with the internal revenue service. By applying strategic tax planning strategies, you can optimize your tax obligation responsibilities and enhance your monetary wellness (Frost PLLC). Allow's explore exactly how these strategies can profit your operations and maintain you on the right side of the law

Significance of Tax Conformity

Although several local business owner check out tax obligation conformity as a laborious responsibility, it's crucial for maintaining a healthy and balanced procedure and preventing pricey fines. Remaining compliant with tax guidelines not only safeguards your organization from audits however additionally builds integrity with clients and stakeholders. By guaranteeing your tax obligation filings are precise and prompt, you lessen the threat of fines and rate of interest fees that can occur from mistakes or late submissions. Additionally, understanding your tax commitments assists you make educated financial decisions, enabling far better capital management. Embracing tax obligation conformity as a top priority can foster a much more orderly operation and advertise long-term sustainability. Keep in mind, positive compliance today can save you frustrations and expenditures tomorrow.

Strategic Tax Obligation Planning Methods

While guiding via the intricacies of business procedures, it's essential to carry out calculated tax obligation preparation methods that straighten with your total monetary goals. Begin by examining your current tax obligation scenario and identifying potential reductions and credit scores that you could be missing out on. Think about tax-efficient investment methods, such as utilizing retired life accounts or tax-loss harvesting, to minimize your taxable revenue. Furthermore, discover entity structuring alternatives that can use tax obligation advantages, like forming an LLC or S-Corp, relying on your organization size. Routinely evaluate your financial forecasts and remain upgraded on tax obligation law adjustments, seeing to it you adapt your methods appropriately. By taking these positive actions, you can improve your service's economic health and assurance compliance while maximizing your tax obligation savings.

Money Flow Management and Optimization

Grasping money flow management is important for any service intending to prosper. You need to keep a close eye on the inflow and discharge of money to ensure you're meeting your financial obligations while additionally spending in growth chances.

Financial Evaluation for Informed Decision-Making

When you're making organization choices, economic evaluation supplies data-driven understandings that can lead your selections. By comprehending your economic metrics, you can tactically designate sources to maximize efficiency and profitability. This strategy not just boosts your decision-making procedure however also supports your general company goals.

Data-Driven Insights

As you browse the intricacies of organization operations, leveraging data-driven insights via financial evaluation comes to be essential for notified decision-making. Making use of tools like control panels and economic models, you gain a clearer photo of your organization's wellness. You'll locate that making choices based on strong data not only minimizes unpredictability yet additionally boosts your self-confidence in guiding your organization in the direction of success.

Strategic Source Appropriation

Reliable critical source appropriation pivots on clear economic evaluation, enabling you to guide your assets where they'll yield the highest possible returns. By evaluating your economic information, you can recognize fads, spot inefficiencies, and focus on investments that align with your company goals. This procedure assists you designate funds to tasks or divisions that show potential for development and productivity.

On a regular basis assessing your economic declarations and efficiency metrics warranties you stay educated, allowing you to adapt promptly to changing market conditions. Additionally, teaming up with bookkeeping services boosts your understanding of resource circulation, ensuring you're not ignoring useful chances. Ultimately, smart source appropriation sustained by monetary analysis encourages you to make enlightened choices that drive success and sustainability in your organization procedures.

Navigating Regulatory Needs and Specifications

Navigating regulatory requirements and criteria can feel intimidating, specifically for services working to maintain compliance while focusing on development. You need to remain notified about the ever-evolving regulations that regulate your industry. This suggests understanding regional, state, and federal guidelines, in addition to industry-specific standards.

To navigate these intricacies, think about collaborating with audit services that concentrate on compliance. Frost PLLC. They can aid you translate laws and execute essential adjustments in your procedures. This partnership not only assures adherence to legal criteria but additionally helps you prevent pricey charges

Additionally, preserving accurate monetary documents can simplify audits and examinations, making your procedures much less difficult. Ultimately, prioritizing conformity permits you to concentrate on development while safeguarding your business's future.

Leveraging Technology in Audit Provider

Staying compliant with regulations is just the beginning; leveraging modern technology can substantially improve your bookkeeping services. By incorporating cloud-based audit software application, you can improve processes, lower errors, and improve information ease of access. This permits you to concentrate on tactical decision-making instead of getting bogged down by manual information access.

Automated devices can aid with invoicing, pay-roll, and cost tracking, saving you time and guaranteeing accuracy. Real-time economic coverage indicates you're constantly in the loop, allowing you to make enlightened choices swiftly.

Furthermore, utilizing analytics tools can provide beneficial understandings right into your service performance, aiding you identify trends and opportunities for growth.

Accepting innovation not just streamlines your audit tasks but additionally boosts collaboration within your group. With the right tools, you can raise your organization operations, making them a lot more efficient and responsive to modifications on the market.

Often Asked Inquiries

How Can Little Businesses Profit From Audit Services?

Local business can streamline financial resources, assurance conformity, and make informed decisions by using accountancy services. You'll save time, lower errors, and gain understandings right into capital, helping your organization flourish and expand efficiently.

What Credentials Should I Look for in an Accounting professional?

When you're seeking an accountant, prioritize their credentials. Check for appropriate certifications, experience in your market, solid communication skills, and a positive strategy. These elements ensure they'll efficiently fulfill your business's special economic needs.

How Commonly Should Businesses Review Their Financial Statements?

You must assess your financial statements at least quarterly. This frequency assists you place trends, make informed decisions, and change your methods as required. Normal testimonials keep you on track with your financial goals.

What Are the Prices Connected With Working With Accountancy Solutions?

Employing accounting solutions entails numerous expenses, like hourly prices or month-to-month retainers, software program costs, and prospective training. You'll wish to evaluate your needs and spending plan to discover the best equilibrium for your organization.

Can Bookkeeping Providers Aid With Company Growth Approaches?

Audit services offer useful understandings into financial health and wellness, assisting you recognize development opportunities. They improve budgeting and forecasting, enabling you to make enlightened choices that drive your service ahead and boost overall success.

Report this page